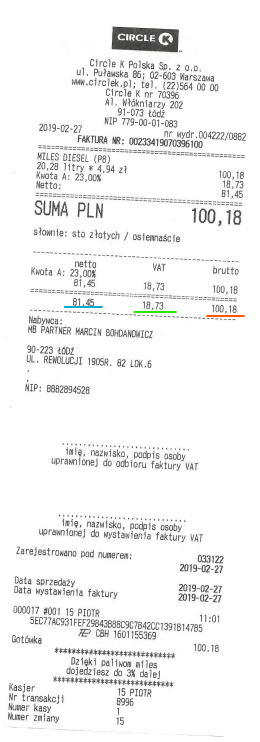

How much refund will I get on the invoice sent? An example of a VAT invoice is shown below. Please note that the invoice for PLN 100 gross does not contain PLN 23 VAT, but only ~ PLN 18.

We distinguish several types of cost invoices:

- Invoice for the operation of the car

- You will receive a VAT refund in the amount of 50% of the VAT amount shown on the invoice – i.e. a refund of PLN 9.36 of VAT can be recovered from the sample invoice.

- We deduct income tax by sending the so-called cost reimbursement. In this case, it will be 75% of the net amount (81.45) + 50% VAT (9.36) = PLN 68.11. Why only 75%? In January 2019 tax regulations have changed, and only 75% of income tax can be deducted for a passenger car without “mileage” driving (legal basis.)

- Total, the settlement will include amounts of PLN 68.11 + 9.36 = PLN 77.47 as reimbursement.

- Other invoices – i.e. electronics, chargers, cables, etc.

- You will receive a full VAT refund, i.e. on the example of this invoice (if it was, for example, for a car charger) PLN 18.73

- The deducted costs in the amount of PLN 81.45

- In total, you would receive PLN 100.18 for your reimbursement.

Remember that we do not reimburse the costs as an “addition” to the salary, but as part of the amount earned. By collecting invoices, you only benefit from taxation.